The majority of the provisions in the Tax Cuts and Jobs Act of 2017 (TCJA) are scheduled to sunset in 2025. Until then, you have an opportunity to use the provisions to your advantage, as long as you know what those advantages might be for you. In some cases, you will find that what appears to be an advantage for others may actually be a disadvantage to you. Knowledge is power!

-

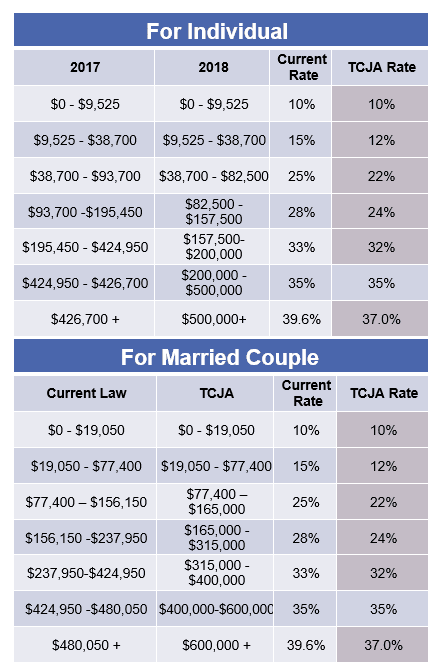

#5 New Tax Brackets – Good News, Bad News

The good news, especially for high-income earners, is the highest tax bracket is down from 39.6% to only 37% starting with the 2018 tax year. However, for the lowest income earners in the 10% bracket, nothing has changed. Another pitfall is that taxpayers may find themselves in a higher tax bracket in 2018 than they did with the same income in 2017. For example, a married couple filing jointly and a single filer with a taxable income of $410,000 were both in the 33% tax bracket in 2017 but will be in the 35% tax bracket in 2018. The good news in this example is that these taxpayers are treated equally, the bad news is they’re both paying more.

-

#4 Personal Exemption – poof!

In 2017, you enjoyed a personal exemption of $4,050 for yourself, your spouse and each eligible dependent. Starting with tax year 2018, the personal exemption no longer exists. No need to worry…maybe…since the standard deduction and the Child Tax Credit increased with TCJA.

-

#3 Child Tax Credit

Starting in the tax year 2018, the maximum credit has increased to $2,000 per child up from $1,000 per child previously. To be eligible, the child must live with you for more than six months of the year, you must claim them as a dependent and the child must be under the age of 17 at the end of the tax year. Each child must also have a Social Security number before the due date of your 2018 return to be claimed as a qualifying child for the child tax credit.

More families will be able to take advantage of the Child Tax Credit with a higher income threshold at which the credit begins to phase out. For Married Filing Joint filers, the phase-out begins at $400,000 of modified adjusted gross income, up from $110,000 in 2017. For all others, the phase out begins at $200,000 of modified adjusted gross income.

There is also a second smaller credit, Credit for Other Dependents, of up to $500 per dependent available to taxpayers supporting older children, parents and other relatives who do not qualify for the Child Tax Credit. For additional information, consult IRS Publication 972.

-

#2 Standard Deduction Almost Doubles!

The best part of the increase in the standard deduction is that everyone is eligible to take advantage of this change. The new standard deduction increased from $6,300 to $12,000 for Single filers, from $9,350 to $18,000 for Head of Household filers and from $12,700 to $24,000 for Married Filing Joint filers. An added bonus, the increased deduction might make recordkeeping a bit easier if your deductions in the past several years have been below the new standard deduction allowed for your filing status. Hold onto your receipts for now, just in case your allowed expenses exceed the new standard deduction levels.

-

#1 Spousal Maintenance – More Good News, Bad News!

Your feeling about this tax law change will depend on if you are paying or receiving Spousal Maintenance, also known as Alimony. For divorce or legal separation agreements that are executed or modified on January 1, 2019, or after, the Spousal Maintenance payment is no longer tax deductible to the spouse making the payment. On the flip side, this means that the spouse on the receiving end does not pay tax on any Spousal Maintenance amounts received. Please note that I highlighted the word modified. For Spousal Maintenance orders in place by December 31, 2018, there is no change to the tax treatment of those payments. However, if a current agreement is modified any time after December 31, 2018, the new tax law change will apply. Careful tax planning is important for those who are making Spousal Maintenance payments under a pre-2019 agreement and find themselves back in Court for any modification of the agreement.

These are just a few of many tax law changes in the Tax Cuts & Jobs Act of 2017, many of which sunset after the tax year 2025. To learn more, you can dig into IRS Publication 5307, as well as other multiple resources including your CPA and CFP® Professional.

*This post should not be construed as tax advice. Please check with your tax preparer or Certified Financial Planner™ to learn how the Tax Cuts & Jobs Act of 2017 affects your personal tax liability. More information can be found at https://www.irs.gov/newsroom/individuals.